28+ mortgage interest and taxes

The remainder is just flat out not. Apply Now With Quicken Loans.

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

Web Tax Implications of a Reverse Mortgage.

. Trusted VA Home Loan Lender of 300000 Military Homebuyers. What More Could You Need. Web Most homeowners can deduct all of their mortgage interest.

VA Loan Expertise and Personal Service. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Web Basic income information including amounts of your income.

Web Homeowners filing taxes jointly can deduct all payments for mortgage interest on loans up to 1 million or loans up to 750000 if made after Dec. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web One of the rules you may hear as a homebuyer is the 2836 rule or the debt-to-income DTI rule.

Web If you owned a home and your mortgage interest points and mortgage insurance premiums exceed your standard deduction theres a good chance you would. Get Your Quote Today. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly.

Ad Compare Mortgage Options Calculate Payments. This itemized deduction allows homeowners to subtract mortgage interest from their taxable. Answer Simple Questions About Your Life And We Do The Rest.

Web With 10 of your floor space exclusive to the renter the program not you will allocate 10 of that which is 60 to the SCH E. Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. You can claim a tax deduction for the interest on the first. Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Ad Compare Mortgage Options Calculate Payments. Homeowners who are married but filing.

Web A mortgage calculator can help you determine how much interest you paid each month last year. What More Could You Need. You can deduct mortgage interest on the first 750000 of the loan or 375000 if youre married and filing.

An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage. Apply Now With Quicken Loans. This rule says that your mortgage payment shouldnt go over 28 of your monthly.

Principal interest taxes and insurance. 2 minutes The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply. Web Aaron is a single taxpayer who purchased his home with a 500000 mortgage.

Web The mortgage interest deduction means that mortgage interest paid on the first 1 million of mortgage debt can be deducted from your taxes through 2025. Web Mortgage interest. Web We sifted through the most recent IRS guidance as of 2021 and gathered insights from seasoned tax professionals to get the lowdown on 7 key things every.

Web Mortgage interest. Contact a Loan Specialist. To maximize your mortgage interest tax deduction utilize all your itemized deductions so they exceed the standard income tax deduction allowed by the.

Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an. He paid 19100 in mortgage interest in 2022 as shown on his 1098 form. Web The mortgage interest deduction is a tax incentive for homeowners.

Web A taxpayer spending 12000 on mortgage interest and paying taxes at an individual income tax rate of 35 would receive only a 4200 tax deduction. But for loans taken out from. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web March 4 2022 439 pm ET. As with property taxes you can deduct the interest on your mortgage for the portion of the year you owned your home.

Homeowners who bought houses before.

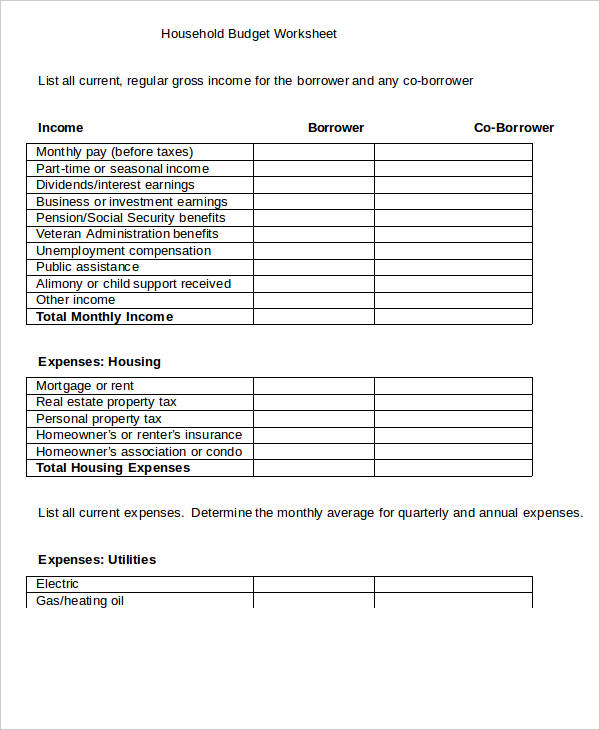

28 Sheet Templates In Word

28 Rate Sheet Templates Word Excel Pdf Document Download

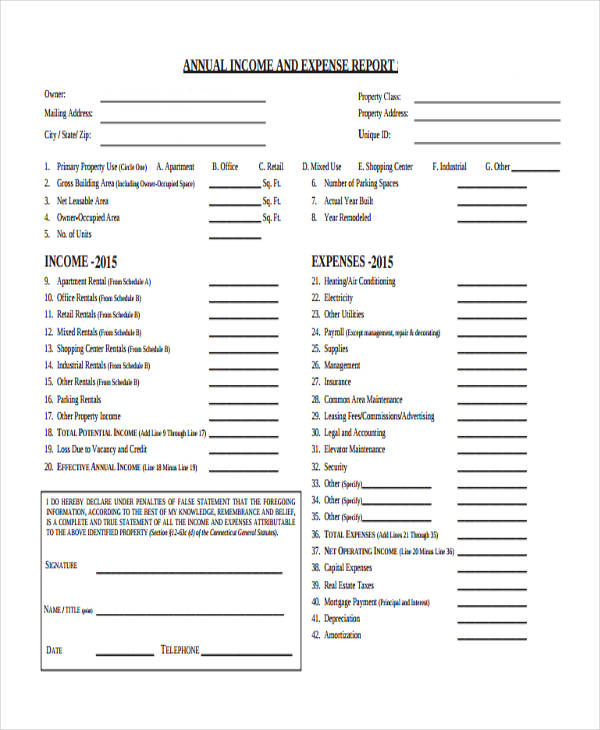

Free 28 Expense Report Forms In Pdf

Mortgage Interest Deduction Who Gets It Wsj

Mortgage Interest Deduction Save When Filing Your Taxes

Home Fairbridge Asset Management Llc

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

56 Nassau Road Roosevelt Ny 11575 Mls 3372015 Howard Hanna

Thinkcar Thinkscan Max Obd2 Car Diagnostic Device For Complete System Diagnostics Car Diagnostic Scanner For Ecu Coding With 28 Service Functions Lifetime Free Update Amazon De Automotive

Gary Basin Garybasin Twitter

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books

1401 80th St E Inver Grove Heights Mn 55077 Zillow

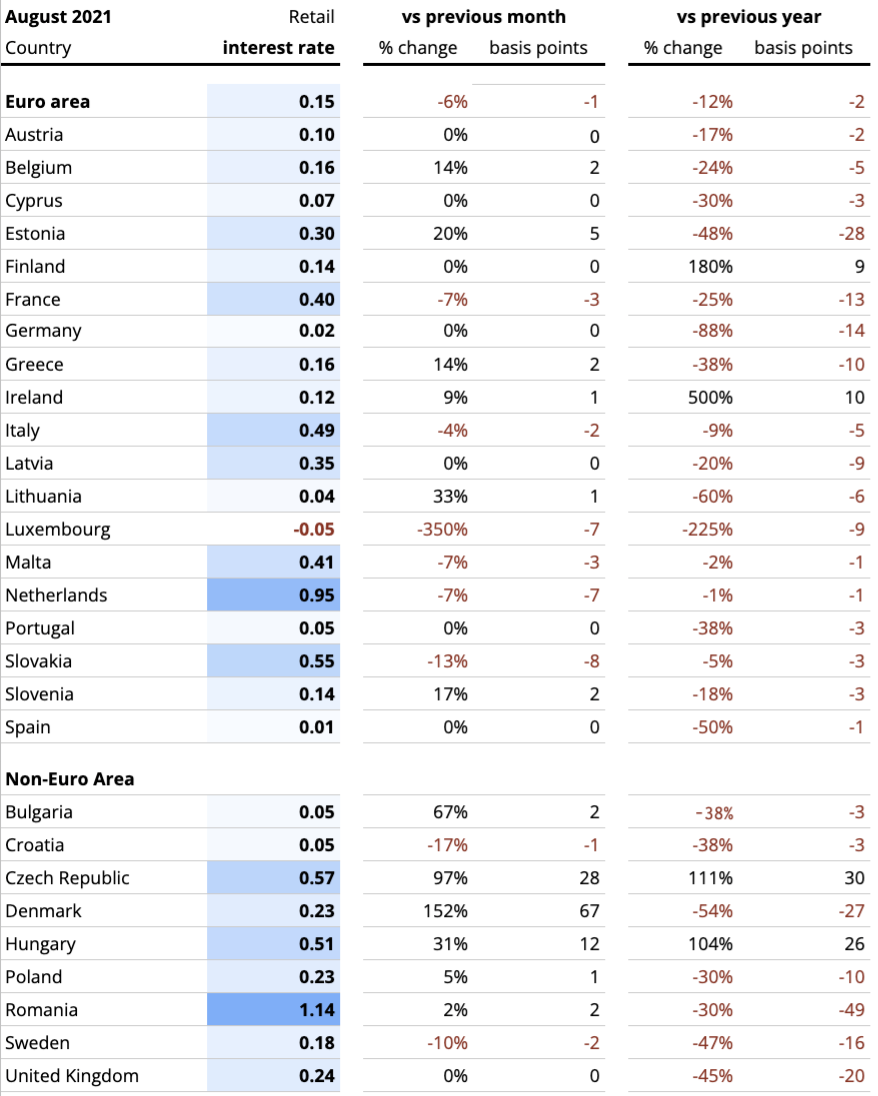

Interest Rates Explained By Raisin

28 Rate Sheet Templates Word Excel Pdf Document Download

Maa Ex99 1s4 Jpg

Break Free From Your Mortgage The Secret Banking Strategy To Help You Pay Off Your Mortgage Fast Kwak Sam Bruce David 9781087973623 Amazon Com Books

Interest Rates Explained By Raisin